There are two professionals every business should bring on-board early on: an accountant and a lawyer. The reasons for hiring an accountant are simply to review your books periodically, and prepare all of your

necessary federal, state and local tax returns. The reason for hiring a business attorney may not be so obvious to every business owner. In this digital age, most individuals have the capability to get things done at a fraction of the cost. However, a good business attorney will provide vital assistance in almost every aspect of your business, from basic compliance and legal advice to formal business incorporation, preventing potential lawsuits, and liability litigation.

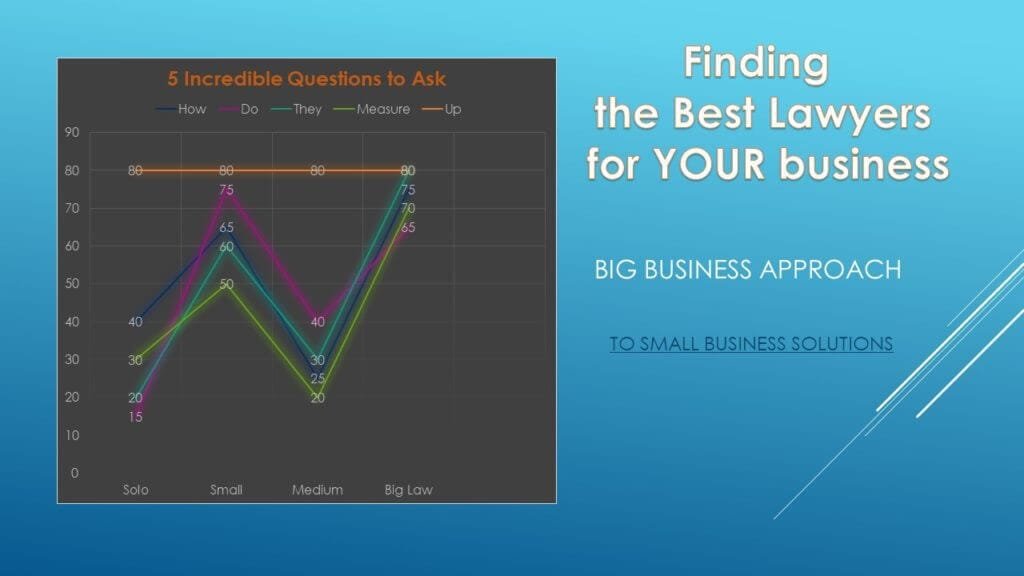

Big Law vs. Small Firms:

Generally speaking, the larger the law firm, the greater the overhead, meaning clients pay higher hourly rates. While larger firms are more expensive to deal with, they have two significant advantages: 1) they usually have all the legal skills you’ll ever need; and 2) they typically have significant standing in the legal community. A nasty letter from a “powerhouse” law firm with offices in 20 states and 60 countries will intimidate far larger corporations than any small firm may be able to. Certainly if you run a fast-growing entrepreneurial company that plans to go public (or sell out to a big company) soon, you will need to work with lawyers whose names are recognized in the investment banking and venture capital communities.

The other 99.7% of businesses in the United States will likely never need the types of services at such high prices. So what kind of services will your business likely require?

Contracts. You will need an attorney who can understand your business quickly. Your attorney must be well-trained to prepare the standard-form contracts your business will need for customers and suppliers and help you respond to contracts that other people will want you to sign.

Business Organization. You will need an attorney who can help you decide the best way to organize your business, whether a corporation (C-Corp or S-Corp), limited liability company (LLC) Partnership (General or Limited), or other types of entities, and prepare the necessary paperwork.

Real Estate. Leases of commercial space for offices and retail stores are highly complex and are always drafted to benefit the landlord. Many lessees may assume that the lease terms are not negotiable because they seem standard. This is not so and your attorney should have a standard “tenant’s addendum,” containing provisions that benefit you, that can be added to the “printed form” lease agreement. Businesses should also utilize their law firms to negotiate these terms.

Taxes and Licenses. Although your accountant will prepare and file your business tax returns each year, your attorney should know how to register your business for federal and state tax identification, and understand the tax consequences of the more basic business transactions in which your business will engage. Your attorney should also be able to help, by teaming up with your accountant, in case you get audited.

The Five

Incredible Questions

1. “What experience do you have?”

Don’t be afraid to ask specific questions about the attorney’s experience. It’s important the attorney understands the most important aspects of your business and can legally guide you along the way.

2. “Can you fix all of my potential legal problems?”

Let’s face it, no attorney can fix every problem. If an attorney tells you they can fix any problem on their own, RUN! A good business lawyer knows their greatest strengths and can amass other legal minds for the areas in which they don’t practice. That’s the type of attorney you want: One that knows where they are weak, but also knows how to turn those weaknesses into strengths for their clients.

3. “Have you worked with other businesses in my industry?”

This tells you two things: 1) does this attorney work with my competitors; and 2) is this attorney a good fit for my business? Neither of these questions necessarily disqualifies the attorney from working with you. It takes you into the next questions of how they will protect your company’s secrets from your competitors, whether there will be any conflicts of interest, and how they will resolve those conflicts (attorneys must follow certain ethics rules).

Now the second question will help you determine whether the attorney will understand the ins and outs of your business. Attorneys have many avenues to learn how to practice in new industries (that is why they shell out hundreds of thousands of dollars for law school). Is the attorney willing to learn?

4. “Are you a good teacher?”

Recall the expression, “Those who can, do; those who can’t, teach.” Well, that doesn’t apply to lawyers. An attorney must be able to “do” and “teach” in order to ensure that their client’s business is successful. Your attorney should be willing to take the time to educate you and your staff about the legal environment of your business. They should be able to guide you, legally speaking, throughout your business cycle. A right attorney will provide such freebies as newsletters that describe recent developments in your field.

5. “What do you charge?”

There are many Cost-Saving strategies that attorney’s can utilize. For many small business owners, a number of options may be available. Undeniably, attorneys are very expensive, but the right attorney will utilize various ways to help minimize their impact on your pockets:

Hourly Rate. Most attorneys bill by the hour.

Flat Fee. Some attorneys charge a flat fee for routine matters, such as reviewing contracts or filing business documents.

Monthly Retainer. If you anticipate asking routine questions, one option is to pay a monthly fee that entitles you to a certain set of services, such as asking questions, filing documents, reviewing contracts, etc.

Contingent Fee. For lawsuits or other complex matters, lawyers often work on a contingency basis. This means that if they succeed, they receive a percentage of the proceeds. If they fail, they receive only out-of-pocket expenses.

Whatever methods you utilize for whichever services you need. Ensure that you obtain an Engagement Letter from the attorney that tells you the scope of the services they will provide in conjunction with the estimated cost.

Need to Contact an Attorney Right Now?